Texas Workplace Injury Compensation Analysis, Options, Impact

ABSTRACT

Workplace injuries affect nearly a quarter of a million1 Texas workers every year. Most of those injured workers have access to workers’ compensation coverage. The Texas workers’ compensation system is designed to be a “no‐fault” system where workers injured on the job can receive medical and wage benefits – regardless of fault – in exchange for granting employers immunity from liability litigation. This contract guarantees a safety net for Texas workers and financial security for Texas employers.

The system, though, has its flaws. When the Texas workers’ compensation law was first enacted in 1913, the structure of the Texas economy was relatively simple; employees arrived for work at a job‐site that was almost exclusively operated by their direct employer. However, the Texas economy has become more dynamic and business operations have become much more integrated. The new Texas economy features much more complex work environments, involving multiple employers working side‐by‐side at the same job site.

In a complex work environment, workplace injuries can be the result of any number of factors, and can potentially involve another party that is not the direct employer of the injured worker. The workers’ compensation system does not preclude an injured worker from seeking damages directly from any 3rd party that is deemed responsible for the injury. The one exception to this statute grants immunity to 3rd parties that directly purchase and administer the workers’ compensation policies of a subcontractor’s employees, though the administrative burden of this structure makes it seldom utilized.

As a result of the limit of immunity only to the direct employer or statutory employer, accidents where a 3rd party is involved can give rise to liability lawsuits. As a practical matter, therefore, the availability of legal recourse against 3rd parties limits the “no‐fault” intent of the system. While the risk for any individual business in becoming the subject of a 3rd party lawsuit is low, the cost and focus required for Texas employers to manage the risk is significant. Moreover, the litigation option is inefficient in distributing benefits to injured Texas workers.

This report presents a brief history of workers’ compensation in Texas, the costs of workplace injuries on subscribers to the system, and the inefficiencies of the 3rd party liability system. The report also discusses the deficiencies in the distribution of benefits to Texas workers with workers’ compensation insurance. Also highlighted throughout the report are the major levers available within the Texas system that are believed to impact workplace safety and contain costs. Because of the 3rd party exception in the Texas workers’ compensation system, significant attention is paid to the effects of litigation against 3rd parties and its impact on injured Texas workers and employers.

This report is a fact‐based analysis of the Texas workers’ compensation system, and does not intend to make specific policy recommendations. It does, however, discuss possible scenarios for addressing key deficiencies of the system. The scenarios presented take two principal factors into consideration:

1) How can benefits to injured Texas employees be improved, and

2) How can the “frictional” costs of the system be reduced? These questions are evaluated against the issue of primary importance to all Texas employers, employees, and government agencies – i.e., maximizing workplace safety.

Note: This analysis uses several sources of base level and compiled data from government agencies, industry research councils, and academic literature. These data provide comprehensive views of workplace injuries, workers’ compensation, lawsuits and settlements. To find answers to the two key questions posed above, it is essential to drill down on the available data, categorizing and summarizing it to extract useful information. In some cases, the data available from the source was at a sufficient level of detail, and/or could be captured in convenient analytical categories to make comparisons and draw conclusions. Some of the data was not directly disaggregated by the source, or not classified in a manner that could illustrate the salient features of the injury compensation system. As a result, this analysis uses a variety of techniques to derive information from the available data. All of the derivations made are based on the source data and use sound estimation techniques that present an accurate view of the data. Where applicable, the data and methodology used are presented within the document as sidebar commentaries. In addition, a detailed explanation of the complete methodology is presented in Appendix A: Methodology.

INTRODUCTION

In the early part of the 20th century, many states across the country began enacting workers’ compensation programs to protect the health and welfare of employees injured during the course of work in exchange for legal liability immunity for employers. In 1913, Texas enacted its first workers’ compensation law giving employers the option to subscribe to the workers’ compensation system. Today, Texas remains the only state with a truly optional workers’ compensation system.2

The Spirit of the Workers’ Compensation System

Today’s work environment is safer and more productive than in any previous decade. However, with a labor force of more than 9 million strong in the State of Texas3, one fact of life remains: workplace injuries and illnesses do and will happen.

Every employee who arrives at their job xsite duly expects to return home unharmed at the end of their day’s work. The workers’ compensation system is designed to compensate workers for accidental injuries and illnesses by providing timely medical care and supplementing the loss of wages due to extended recovery periods.

The implicit contract that the workers’ compensation system provides between an employee and his or her employer is that an insurance safety net is available for the employee to cover the financial cost of an accidental injury or illness suffered on the job. This safety net for the employee is intended to be a “no‐fault system” – i.e., it does not take into account any contributory actions on the part of either the employer or employee, exchanging medical and wage benefits for employer immunity from legal recourse. This system provides fundamental protection for workers who are injured as a result of their own actions, while simultaneously protecting employers from lawsuits for injuries in which the employer is responsible. The system puts the focus of all parties involved on timely treatment and recovery – a benefit to the injured party – rather than on litigation of liability.

Administration of Workers’ Compensation in Texas

The Texas Department of Insurance (TDI) is the state agency designated to oversee the workers’ compensation system in the State of Texas. The Division of Workers’ Compensation (DWC) is an established unit within the TDI that administers and operates the workers’ compensation system. The TDI Property and Casualty Division establishes the job classification relativities4,5 and expected loss rates to assist the National Council on Compensation Insurance (NCCI) in calculating experience modifiers4 used by insurance carriers to determine policy premiums. The DWC also provides workplace safety and health services as well as dispute resolution services by providing injured workers with an ombudsman from the Office of Injured Employee Counsel (OIEC) 6 to guide him or her through the resolution process.

There are four basic types of workers’ compensation benefits that are available to injured/ill workers: medical, income, death, and burial benefits.7 Income benefits are gauged to the severity and differ according to the nature and duration of the injury or illness. The following is a description of the various benefits:

Medical Benefits – Employees who suffer a work‐related injury or illness receive medical care for the injury or illness for as long as necessary for full recovery until Maximum Medical Improvement (MMI).

Temporary Income Benefits (TIBs) – TIBs are income benefits paid to an employee who loses all or part of their wages for more than 7 days due to a work‐related injury or illness. TIBs are paid until the injured worker returns to work, reaches MMI, or has received 104 weeks of TIBs, whichever occurs first.

Impairment Income Benefits (IIBs) – IIBs are income benefits paid to an employee who has sustained a permanent impairment (permanent damage to the body) from a work‐related injury or illness and who have reached MMI. For every percentage of impairment, an injured/ill employee receives three (3) weeks of IIBs. IIBs benefits expire after 401 weeks from the date of injury

Supplemental Income Benefits (SIBs) – SIBs are income benefits paid to an employee who has an impairment rating of 15 percent or more, and who has not returned to work or who has returned to work but is earning less than 80 percent of their average weekly wage prior to the injury. SIBs are paid to those injured/ill employees who have not received their IIBs in a lump sum payment. SIBs expire after 401 weeks from the date of injury.

Lifetime Income Benefits (LIBs) – LIBs are income benefits paid to employees who have sustained certain work–related injuries qualifying them for lifetime benefits – e.g., loss of sight in both eyes or loss of both hands at or above the wrist.

Death and Burial Benefits – Death benefits pay a portion of lost family income for dependent family members of employees killed on the job. Burial benefits pay for some of the deceased employee’s funeral expenses.

For injured workers, medical and wage replacement benefits are paid by workers’ compensation insurance carriers, by employers certified by the DWC to self‐insure, or by self‐insured governmental entities. Private insurers underwrite the liability for worker injuries under workers’ compensation provisions outlined in the Workers’ Compensation Act. They also provide claims management and administration functions.

Most private businesses in the State of Texas subscribe to the workers’ compensation system. Some very large employers bypass the insurance companies and operate as qualified self‐insureds as a way to manage costs. Businesses that opt to self‐insure are required by the State to prove financial stability and set aside reserves on their balance sheet. To protect assets from catastrophic loss, many self‐insured companies will purchase catastrophic loss coverage with exceptionally large limits.

Checks and Balances

For injured workers, the workers’ compensation system is designed to provide complete medical coverage as well as adequate partial replacement of wages during the period of injury layoff. Properly designed, an injury recovery system should provide the necessary medical treatment and rehabilitation services required to return an injured worker to work in as short a time as possible.

While it is not the purpose of this report to identify the most successful or unsuccessful strategies for promoting injured worker recovery and eventual return to work, the evidence suggests that, in general, defined benefit and recovery systems have shown better success in increasing return to work rates and decreasing system abuses than earlier, less regulated systems. By offering incentives for injured workers to participate proactively in their own recovery and return to work, quality benefits can be ensured while maintaining control over costs.

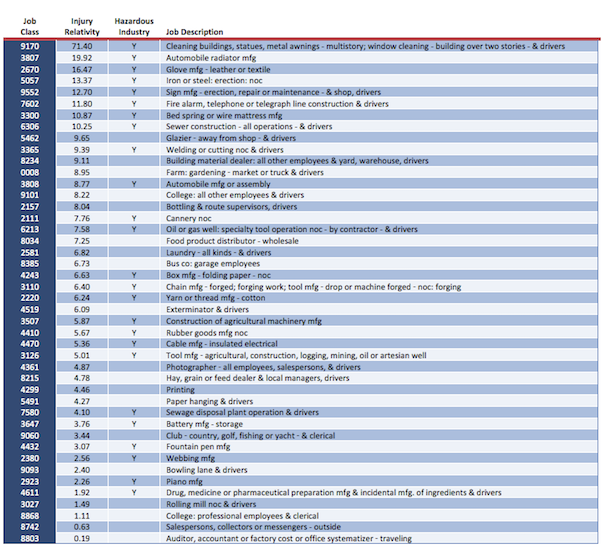

For employers who participate in the workers’ compensation program, insurance premiums paid are based on risk. Certain job categories are riskier than others and certain employers have better safety records than others. In Texas, the variance in risk profile for each employee by job category is determined by the TDI in its workers’ compensation job classification relativities table.

The risk is then adjusted further by an experience modifier assigned to each employer to account for their respective injury claims history. In other words, employers that offer a safer workplace are rewarded with lower workers’ compensation premiums.

From the employer perspective, the current rating system is designed to reward safe employers while penalizing those that are less safe. It provides a system of checks and balances that ensure employers institute effective safety programs and instill a culture of safety in the behavior of every employee while on the job. In addition, when major workplace injuries do occur, work stoppages are often employed to conduct additional inspections, investigations, and training. These work stoppages are costly and can lead to a significant amount of lost productivity.

The primary drawback of the “premium as enforcer” system is that it is a delayed, reactive system. The economic penalty for workplace accidents is realized by employers in future years with the adjustment in their experience modifier. Additionally, because the principle of insurance is to spread the risk among all policy holders in the insurance pool, the cost of a workplace injury is not always borne directly by every employer.

Employers do have alternatives to reduce their experience modifiers. Employers may work with their insurance carriers to determine a schedule rating based on the implementation of certain safety devices that have a documented positive impact on loss rates. Employers may also work with their insurance carriers to arrive at a negotiated experience modifier. This lever is a further adjustment to premiums paid based on an employer’s documented implementation of additional safety programs that would positively impact workplace safety.

Recent Reforms to the Texas Workers’ Compensation System

Texas enacted the first workers’ compensation laws in 1913 with the principle that employers can choose to offer coverage to their employees. While the workers’ compensation system remained largely unchanged until the 1980s, the Texas legislature realized that reforms were necessary to deal with high injury rates, high medical costs, and high litigation costs that were driving workers’ compensation carriers out of the State. The Texas Legislature adopted the Texas Worker’s Compensation Act – Senate Bill 1 – in 1989 to bring about these reforms.

Among its provisions, the Act created the Texas Workers’ Compensation Commission (TWCC) to administer the workers’ compensation system. The Act also improved benefit delivery and the dispute resolution process. Since rising medical costs were primarily responsible for the significant increase in Workers’ Compensation costs, the legislature called for the development of medical fee and treatment guidelines to control medical costs and limit attorneys’ fees. In addition to the development of these medical guidelines, the legislature aimed to decrease the incidence of workplace illness/injury rates by enhancing and expanding state‐administered workplace health and safety programs.

Despite the reforms of the 1989 Act, workers’ compensation medical costs continued to be significantly higher than the national average through the 1990s8 until additional rounds of reforms were enacted beginning in the early 2000s. The reforms sought at that time addressed the concerns raised by system participants about high medical costs, difficulties with access to medical care, and poor return‐to‐work outcomes.

These reforms of the early 2000s coincided with the scheduled Sunset review of TWCC in 2005 by the Sunset Advisory Commission which resulted in a series of significant legislative recommendations. In response to these Sunset recommendations and with input from system participants, the 79th Legislature adopted House Bill 7 in 2005 that detailed a number of reforms including:

Healthcare Delivery Networks – Following success in reducing medical costs through health networks in other states, workers’ compensation health care delivery networks were formed to improve the quality of medical care, reduce costs, and introduce more efficient cost containment measures. With the creation of these networks, the Division’s Approved Doctors’ List was abolished.

Creation of the DWC – The administration of the workers’ compensation system was transferred to the DWC at the TDI following the closing of the TWCC.

Creation of the OIEC – The OIEC was created to assist unrepresented injured workers during DWC dispute proceedings.

Administrative Improvements – A number of administrative changes were developed to streamline medical and income benefit dispute resolution processes and enhance continual improvements in return‐to‐work rates in Texas.

The impact of the 2005 reforms on workers’ compensation system cost, benefits administration and adequacy, and injured workers’ outcomes are expected to emerge in the coming years as data becomes available. The recent changes are expected to bring about a reduction in medical costs as medical services are integrated through these new healthcare delivery networks. These reforms are also expected to improve return to work rates, reducing loss time costs, and overall system costs.

The foregoing discussion applies to subscribers to the Texas workers’ compensation system; however, 1 in 4 Texas employees9 is working for an employer who does not subscribe to the workers’ compensation system. Injury and illness recovery of workers not covered by workers’ compensation insurance is managed through other employer‐defined arrangements. The difficulty in obtaining data on injured workers in non‐subscribing companies – in terms of costs, benefits, and return to work rates – makes it a challenge to compare their outcomes to injured workers whose employers are subscribers to the workers’ compensation system.

Policy Benefits to State Economic Development

A good workers’ compensation system can provide significant economic and social benefits to the health of the State’s overall economy. By providing medical treatment and income replacement to injured workers, Texans can rest assured that mortgages can continue to be paid and families will not be displaced as a result of an unfortunate workplace injury or illness. At the same time, a properly administered return‐to‐work program also benefits employers by curtailing productivity losses resulting from protracted leaves of absence due to workplace injury or illness.

The liability immunity that the workers’ compensation statute provides Texas employers also provides significant benefit to the Texas economy by lowering the frictional cost of defending and prosecuting liability litigation. In certain extraordinary instances, liability immunity could also be credited for preventing layoffs and/or bankruptcy that would possibly result from a severe legal judgment against a small or mid‐sized Texas company. The resulting savings are passed on to employees, direct customers, and ultimately to end consumers.

Complex Work Environments in a Dynamic Economy

The current worker’s compensation system creates a closed loop system of recourse for workers injured on the job, regardless of whether fault lies with the employee or the employer. This system, however, inadequately addresses the demands of a more integrated and dynamic economy with complex work environments, where multiple employers may be involved in working on the same job site.

Texas workers’ compensation law does allow 3rd party immunity where a primary employer – e.g., a general contractor – administers and pays directly for each covered employee’s workers’ compensation premium. However, because of the costs associated with administering this type of program, this structure is used only in rare occasions where the size of the operation is large enough to render the administrative costs effective. In other words, the administrative burden required to implement this particular structure makes it a minimally exercised solution. In addition, the immunity protections granted to the payer of the workers’ compensation premiums is not afforded universally to all non‐associated subcontractors participating at the same job‐site (See Appendix B for legal review of code and case history).

Thus, the majority of workers’ compensation job site structures fall under the closed loop system described above. The discussion below describes a “normal” working environment in which each employer pays its own workers’ compensation premiums.

In some industries such construction and oil and gas drilling, multiple employers are engaged at the same job‐site and employ workers performing side‐by‐side duties. A typical construction project, for example, involves multiple subcontractors who have been hired by the general contractor or the developer to complete specific tasks. Employees of subcontractors are not considered the employees of the general contractor, developer, or owner. Thus while workers’ compensation provides a subcontractor protection from liability litigation by its own employee, the same protection does not accrue to any other employer on the job‐site.

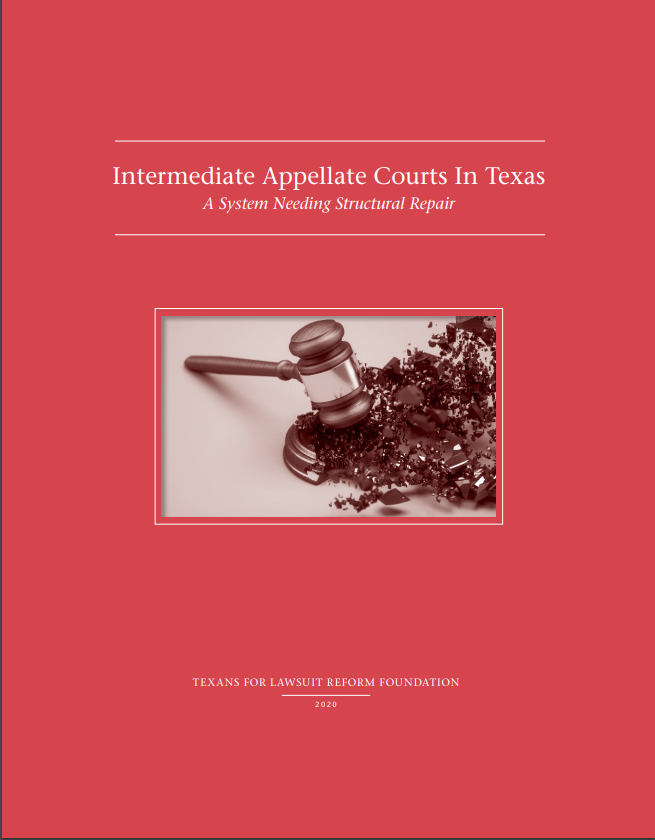

To illustrate, an injured worker on a construction site is entitled to collect workers’ compensation benefits from his or her employer. Under the workers’ compensation agreement between employer and employee, this particular injured worker cannot initiate legal action against his/her direct employer. However, if he/she has cause to believe that the injury or illness was the direct result of any other employer engaged at the job‐site, the injured worker can initiate legal action. If the injured worker is not a direct employee of the general contractor or owner, the latter can be the target of a 3rd party action as well.Figure 1 details the workers’ compensation and 3rd party liability relationships at a single‐employer job‐site versus a complex work environment. At the single‐employer job‐site, the injured employee (yellow) is entitled to receive standard workers’ compensation benefits from his or her employer (green) but does not have any legal recourse against the employer. In complex work environments, the injured employee (yellow) cannot sue his or her direct employer (green), but can sue any of the other employers operating on the same site (red).

Figure 1

In the case of an injury occurring as the result of the actions of a non‐related party, the system loses a significant amount of efficiency and effectiveness in dealing with workplace injuries. The system’s statutory protections for employers or property owners also begin to breakdown when 3rd party actors are involved. For complex work environments, this limitation of the workers’ compensation statute poses many risk management challenges and creates a significant amount of frictional costs. Regardless of whether workers’ compensation insurance is available to the injured worker, immunity from legal liability does not extend beyond the injured worker’s direct employer. Under the current system, 3rd party liability claims are managed through each employer’s general liability or multi‐peril policy. Because liability for 3rd party injuries are not actuarially defined, frictional gaps exist for both the safety management of on‐site 3rd party participants and the level of general liability coverage needed – e.g., any individual claim could result in a liability payout of between zero and tens of millions of dollars.

On an industrial scale, large, complex projects involving multiple entities expose each participant to liability from workers not defined as their direct employees. Each company seeks to protect itself against 3rd party lawsuits by purchasing general liability insurance and/or requiring contractual indemnity protection from their business partners and subcontractors.

The impact of 3rd party lawsuits is also felt on a smaller scale. Individual homeowners and small business owners are especially at risk of 3rd party injury lawsuits resulting from the home or business becoming a temporary job‐site where non‐related workers are present. Employers that subscribe to the workers’ compensation system are protected from employee litigation if one of their employees slips and falls in the process of a home renovation or on‐site small business repair. However, the homeowner or small business owner may become the subject of litigation from the injured employee. While not part of this study, the potential impact and consequences of this litigation hazard are significant.

The threat of litigation increases a project’s cost as different entities in the hierarchy purchase multiple liability policies. As a result, the direct effect is an overall increase in the cost of insuring a job‐site, and the indirect effect is an increase in legal and administrative costs due to stringent scrutiny of contractual and insurance provisions with multiple layers of coverage. These increased project costs are eventually passed on to the end consumer, resulting in unnecessarily higher prices for goods and services.

COST IMPACT OF WORK RELATED INJURIES

The most effective cost management tool for workplace injuries is prevention. The safe workplace benefits from lower insurance premiums and higher productivity. In 2007, however, subscribers paid roughly $2.5 billion in premiums.10 Third party lawsuits arising from workplace injuries added an estimated $0.24 billion in cost on just under 400 cases.11

Managing work-related injuries and illnesses represent a significant cost of doing business in the State of Texas. The Texas workers’ compensation system provides for the following remedies to an employee who suffers a workplace injury or illness:

-

- Employees Covered by Workers’ Compensation:

a. Statutory Medical and Wage Benefits – For injured employees whose employer subscribes to the Texas workers’ compensation system – and becomes injured or ill as a result of their own actions or the actions of their employer – the injured employee’s sole remedy for compensation is limited to the statutory medical and income benefits of the Texas workers’ compensation system.

b. Legal Claim due to Intentional Act or Assault – In the case an employee is injured as a result of an intentional act by an employer or an assault committed by another employee that is directly attributable to the employer, an employee covered by workers’ compensation may pursue legal action against an employer.

c. Wrongful Death Claims – In the case of a workplace death, the family of the deceased has the right to sue the employer when the death was caused by gross negligence or the intentional act of the employer.

d. Legal Claim Against 3rd Party Cause of Injury or Illness – In cases where an employee suffers a workplace injury or illness attributable to an entity that is not the direct employer, the employee may pursue legal action against parties allegedly at fault. - Employees Not Covered by Workers’ Compensation:

a. No Benefits – For injured employees whose employer is a non‐subscriber to the Texas workers’ compensation system and becomes injured or ill while at the workplace, the employer is under no legal obligation to provide medical or wage benefits to workers injured at the workplace. Some workers may receive no benefits as a result of a workplace injury.

b. Medical and Wage Benefits – For injured employees whose employer is a non‐subscriber to the Texas workers’ compensation system and becomes injured or ill while at the workplace, the injured employee may receive medical treatment or supplemental lost wage income provided by their employer.

c. Wrongful Death Claims – In the case of a workplace death, the family of the deceased has the right to sue the employer regardless of the death benefits provided by the employer.

d. Legal Claim Against Employer or 3rd Party – Any work‐related injury or illness suffered by an employee whose employer is a non‐subscriber to the Texas workers’ compensation system, the employee retains the right to pursue legal action against their employer or a 3rd party actor.12

- Employees Covered by Workers’ Compensation:

The Texas Workers’ Compensation System: Freedom of Choice

The Texas Workers’ Compensation system, along with New Jersey, is unique among its peers as the only systems in the nation that do not mandate compulsory participation by all employers.13 This option system provides freedom of choice for both employer and employee to: participate in the statutory workers’ compensation system; or to create or participate in a customized program. Because of this dynamic, the statutory workers’ compensation system in the State of Texas represents a much smaller component of the state’s economy than in other states.

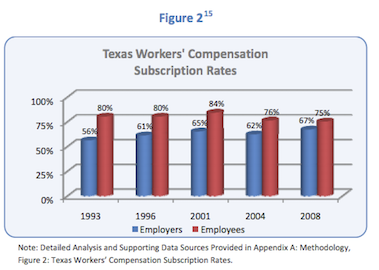

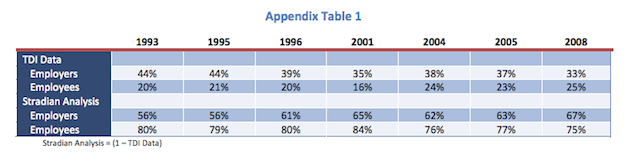

During the late 1980’s, workers’ compensation system costs and premiums began to skyrocket due to a lack of defined benefit controls and widespread abuse – through employee or healthcare provider fraud – of the workers’ compensation system.14 As a result, insurance carriers began dropping out of the Texas market while employers began leaving the workers’ compensation system in favor of managing their own injury risk. Reforms to the Texas workers’ compensation system and Occupational Safety and Health Administration (OSHA) regulations in the late 1980s and early 1990s helped to improve workplace safety and reduce the cost of disability management. Currently, just over two‐thirds of Texas employers subscribe to the Texas workers’ compensation system representing three‐fourths of all Texas workers. Figure 2 shows the trends in subscription rates for Employers and Employees.

Figure 215

Note: Detailed Analysis and Supporting Data Sources Provided in Appendix A: Methodology, Figure 2: Texas Workers’ Compensation Subscription Rates.

Most Texas non‐subscribers fall into two basic categories: very large and very small companies. Very large companies that opt‐out of the workers’ compensation system do so primarily because they are large enough to manage the risk of administering their own system and can do so at a lower cost. Small companies that opt‐out tend to do so as a result of the high cost of workers’ compensation premiums. The remaining segment of mid‐sized companies accounts for the bulk of subscribers to the workers’ compensation system in the State of Texas.

Over a 15‐year period, subscription rates among Texas employers increased from 56 percent in 1993 to 67 percent in 2008. Over the same period, the number of Texas workers covered by workers’compensation has decreased from 80 percent to 75 percent. The trends indicate growth in very large companies becoming non‐subscribers.

The remainder of this report will focus on subscribers to the Texas workers’ compensation system.

Workers’ Compensation System Cost Comparison:

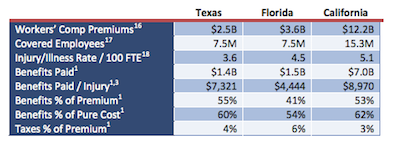

Texas, Florida, and California

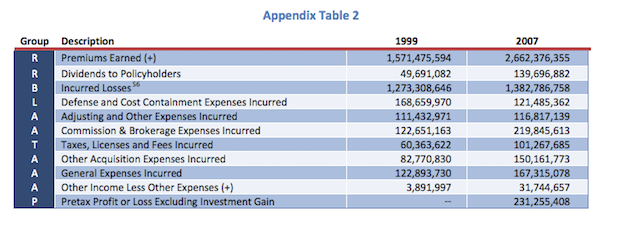

In 2007, the Texas workers’ compensation system distributed benefits to injured Texas workers more efficiently, and at lower cost, than either Florida or California. Table 1 outlines the relative costs of each state’s workers’ compensation system. While Texas covers roughly the same number of employees under workers’ compensation as Florida, Texas delivers those benefits at roughly 70 percent of the cost. The California system – while roughly as efficient as Texas in delivering benefits as a percentage of the premiums collected from subscribing employers – has much higher costs due to higher accident rates and higher benefits payouts per incidence.

Table 1

The controlling factors with regard to the difference in benefits plans among the states represent moderate differences. All three States provide roughly 2 full years of TIBs, provide for additional IIBs, and have long‐term disability benefits built into their systems, SIBs and LIBs. While the current 2008 maximum weekly income benefit19 levels for Texas and Florida are nearly the same – Texas = $712, Florida = $746 – California provides for a much higher maximum weekly benefit of $916. The major differences in each state’s system cost result from the claims approval and medical treatment processes and the injury and illness rates presented later in this report.

Economic Impact of Workplace Injury and Illness on Texas Subscribers

The cost of workers’ compensation premiums on Texas employers totaled $2.5 Billion in 2007 covering 7.5 million workers20. The secondary cost of workplace injury and illness21, 3rd party liability, totaled another $0.24 Billion (est.) encompassing all settlements, awards and general liability premiums22. As a percentage of the $1.1 Trillion Texas economy23, workplace injury costs account for a relatively low share, but for certain hazardous industries, the cost impact of workers’ compensation and personal injury liability can account for a significant portion of operating costs.

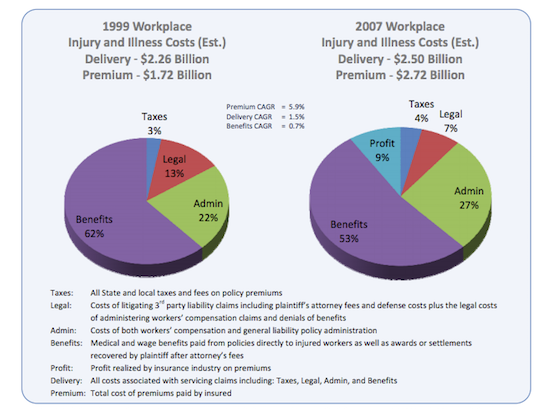

Note: Detailed Analysis and Supporting Data Sources Provided in Appendix A: Methodology, Figure 3: 1999 and 2007 Workplace Injury and Illness Costs.

Note: For this economic impact estimate the cost of workers’ compensation represents the cost of insurance premiums only and does not include company expenses such as deductibles paid, insured company risk management staff, legal expenses, or minor injuries for which claims are not submitted. Insufficient data exists to determine the magnitude of these costs, however, inconclusive data suggests that at the high end of the range, the deductibles component may fall between $1.2 to $1.5 Billion in direct out of pocket expense while company staff and legal expenses are unknown. These items have been excluded from this analysis due to this large discrepancy in estimates. The 3rd party data contains reliable information on insurance claims cost, deductible payments, and company paid legal defense fees and these figures are included in the cost estimate. Deductible payments for 3rd Party costs are not included in premium.

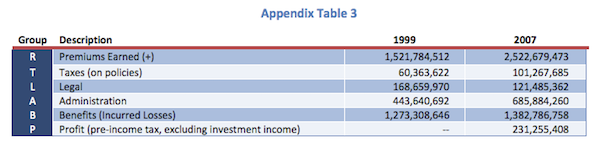

Figure 3 shows the change in workplace injury and illness cost to Texas businesses between 1999 and 2007. During the 8‐ year study period, premiums increased an average of 5.9 percent per year while benefits, awards, and settlements accrued to injured workers increased at only a 0.7 percent annual rate. Part of this dynamic is due to a combined ratio of greater than 1.0 during the late 1990s and early 2000s. Statewide profitability in workers’ compensation underwriting did not re‐emerge until 200424, and general liability underwriting for 3rd party liability did not show profitability again until 2006.25

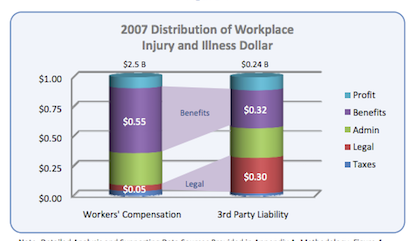

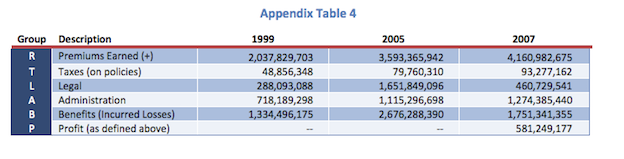

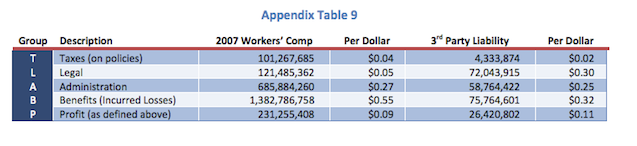

The charts in Figure 3 illustrate the composite breakdown of both workers’ compensation costs and benefits, as well as the costs and benefits for 3rd party liability claims.26 The relative share of 3rd party liability was 13 percent in 1999 and 6 percent in 2007. However, only 32 cents of each dollar spent on 3rd party liability claims actually benefits the injured worker, whereas 55 cents of every workers’ compensation dollar spent benefits the injured worker. Figure 4 breaks down these distributions by workers’ compensation and 3rd party liability.27

It is important to note the inefficiency of the 3rd party liability system. As a share of total dollars spent, the benefit that injured workers actually receive via 3rd party litigation is significantly less than their share of each workers’ compensation dollar. This high frictional cost is due to higher administrative costs and significantly higher legal fees resulting from defense and plaintiff’s fees.28 In other words, the plaintiff or injured worker receives a very small portion of the total amount spent on their lawsuit as compensation for their injury.

Figure 4

Note: Detailed Analysis and Supporting Data Sources Provided in Appendix A: Methodology, Figure 4: 2007 Distribution of Workplace Injury and Illness Dollar.

Economic Impact of Workplace Injury and Illness in Hazardous Industries

Industries such as construction, oil field services, refining, and manufacturing operate hazardous work environments with a higher propensity for workplace injury and illness. These industries do exhibit higher rates of injury and illness, including serious injuries, compared with other industries. The job classification relativities tables produced by the TDI illustrate this point. Hazardous jobs such as iron and steel erecting (class 5040) have relativity bases of 29.68 whereas automobile sales (class 8748), for example, are assigned a much lower relativity of 0.81.29 Of course a wide variety of relativities exists in between these two examples for a number of job classifications. The Appendix contains a sample list of job relativities.

Hazardous industries also exhibit a tendency to operate complex work environments with multiple employers operating side‐by‐side. While not exclusively a 100 percent match, hazardous industries do serve as a reliable proxy to describe the workers’ compensation challenges of a complex work environment. This phenomenon is especially true in the construction industry where a general contractor may manage up to 100 or more specialty sub‐contractors ranging from electrical to pipe‐fitting to brick laying. Other hazardous industries such as oil patch field services, refining, and manufacturing also may operate with multiple specialty contractors, though normally fewer in number.

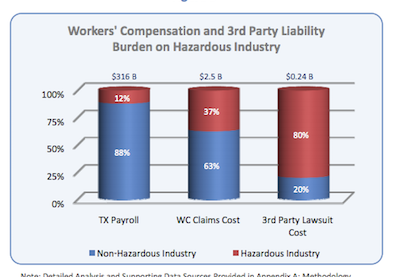

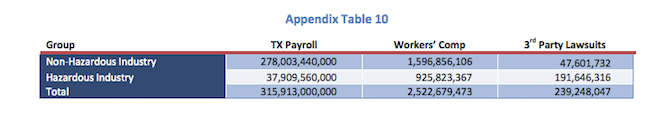

Hazardous industry workplaces, where workers from multiple employers converge, pose a challenge to the traditional workers’ compensation system. Because of the hazardous nature of the work environment, and the opportunity to be injured in an accident involving a 3rd party, the propensity for lawsuits in these industries is much higher than in lighter industries. Figure 5 highlights the disproportionate workers’ compensation claims cost in hazardous industries compared with other Texas industries. In addition, the chart also illustrates the disproportionate distribution of legal settlements and awards for workers injured in hazardous industry accidents.

Figure 5

Note: Detailed Analysis and Supporting Data Sources Provided in Appendix A: Methodology, Figure 5: Workers’ Compensation 3rd Party Liability Burden on Hazardous Industry.

WORK RELATED INJURY PROFILE

Workplace safety and health standards are designed to reduce the occurrence of personal injury and illness in the workplace. Occupational injury/illness rates increased in both number and severity throughout the 1970s and 1980s. The increases in accident rates prompted OSHA to intensify enforcement and education programs aimed at reducing injury rates (especially in hazardous industries). The primary benefit from these programs was a significant decline in injury/illness rates.

Improving workplace safety also impacts the cost of workers’ compensation insurance through a reduction of the direct cost of injuries – e.g., loss wage payments and medical care expenses. Safe workplaces also benefit from reductions in indirect costs – e.g., lost productivity and the cost of hiring or training overtime or temporary replacement workers. While there are a number of factors that determine the workers’ compensation system cost, injury/illness rates continue to have a significant impact – more injuries means higher cost30

Workplace Safety

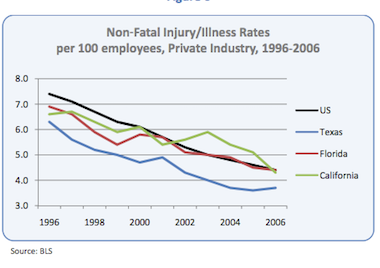

An important driver in the Texas workers’ compensation system is the non‐ fatal occupational injury/illness rate.31 The system cost is affected by the rate and severity of loss time injuries due to a significant portion of benefits being paid to injured workers to replace lost wages. As illustrated in Figure 6, between 1996 and 2005, non‐fatal occupational injury/illness rates in the United States decreased 38 percent from 7.4 to injuries per 100 full‐time employees (FTE). Texas has shown consistently lower injury/illness rates compared with the national average and other large states. In 2006, the Texas injury/illness rate of 3.7 per 100 FTEs was 16 percent lower than Florida and the national average, and 15 percent lower than California.

Figure 6

Source: BLS

Hazardous industries have a higher risk of workplace injury and illness. They reported an illness/injury rate of 4.3 per 100 FTEs compared to 2.6 per 100 FTEs in non‐hazardous industries.32 While these industries represent only 12 percent of payroll costs in the state of Texas, they represent 29 percent of non‐fatal occupational injury/illness cases (approximately 72,000 cases per year).

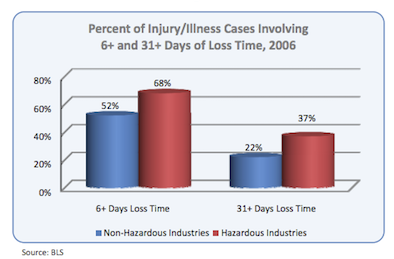

Hazardous industries in Texas also exhibit a significant number of workplace injury cases with a greater length of loss time. For those injuries that involve lost time, hazardous industries exhibited a 68 percent chance of an incident requiring 6 plus days of loss time compared to 52 percent of injuries for non‐hazardous industries. Injured employees working in hazardous industries also had a 37 percent chance of missing 31 plus days compared to employees in non‐hazardous industries who showed a 22 percent chance. These figures suggest that injured employees in hazardous industries suffer more serious injuries and require longer recovery periods than those in non‐hazardous industries.

Figure 7

Source: BLS

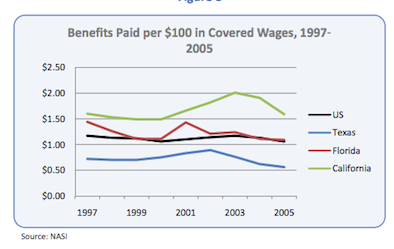

Cost Impact of Occupational Injury/Illness

As shown in Figure 8, Texas paid less in benefits per $100 of covered wages than the national average, Florida or California.33 The lower relative benefits costs in Texas are mainly due to lower injury/illness rates, lower caps in the maximum weekly wage benefit, and lower average weekly benefits of injured workers. Although costs rose steadily during the 1990s, the Texas workers’ compensation system has experienced a reduction in the average number of weeks that injured workers have drawn temporary disability benefits, down from 26 weeks in 2000 to 14 weeks in 2006.34 This 43 percent decrease in the duration of temporary disability benefits had a significant impact on cost as over 40 percent of injuries each year claim TIBs.

Figure 8

Source: NASI

Texas has also managed to reduce income benefit disputes annually from approximately 18 percent of all income benefit claims in 2000 to 9 percent in 2004. Streamlining the benefit structure process has led to fewer disputes and a reduction in overall administrative costs.

Injury Severity

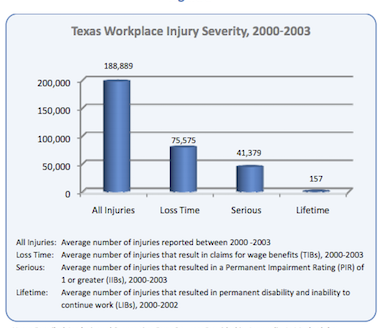

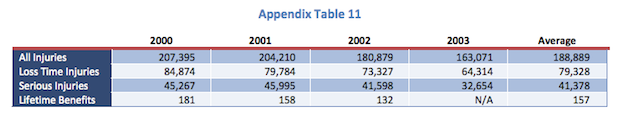

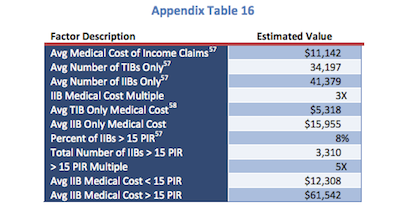

Between 2000 and 2003, approximately 190,000 workers’ compensation injuries were filed each year in Texas. As shown in Figure 9, 40 percent of those injuries are Loss Time Injuries (LTI), or injuries that result in 8 days or more of lost wages. Of those LTIs, more than half (55 percent) are serious injuries which qualify for IIBs. IIBs are given to injured workers who have met all three of the following requirements:

- Reached MMI

- Sustained permanent impairment

- Exhausted their temporary income benefits

Based on workers’ compensation claims that are filed annually, Texas has a higher incidence of injuries resulting in 8 plus days of loss time in comparison to Florida and California35. When comparing injury severity in hazardous industries among the 3 states, Texas reports a greater likelihood of an injured worker missing 8 plus days of work.36

In an industry such as Natural Resource and Extraction, for example, injured Texas workers who experience loss time had a 70 percent chance of missing 6 plus days37 compared to 47 percent and 58 percent for Florida and California workers, respectively. Similarly, injured Texas construction workers had a 71 percent chance of missing more than 6 days of work compared to 54 percent and 59 percent for Florida and California workers, respectively.

In more severe injuries, injured Texas Natural Resource and Extraction workers had a 41 percent chance of missing 31 plus days of work compared to 18 percent and 30 percent for Florida and California workers, respectively. The reasons for these higher incidence rates in Florida and California are likely due to workers suffering more serious injuries and reporting poorer return to work outcomes. Texas employers may also be more successful in reducing the incidence of minor injuries.

Figure 9

Note: Detailed Analysis and Supporting Data Sources Provided in Appendix A: Methodology, Figure 9: Workers’ Compensation 3rd Party Liability Burden on Hazardous Industry.

Texas has consistently paid more in medical cost38 as a proportion of total cost compared to Florida or California. This distribution of cost may be partly explained by serious injuries requiring more medical interventions such as surgery and rehabilitation services. However, it is important to note that this report examines data that precedes the 2005 reforms to the Texas workers’ compensation system. One of the main goals of those reforms was to control medical costs through the introduction of healthcare delivery networks. Future data may better explain the relationship between the severity of injuries, loss time, and medical costs incurred in the Texas workers’ compensation system.

Fatal Occupational Injury/Illness

Despite a continual reduction in the non‐fatal occupational injury/illness rate in Texas since 1992, the number of fatal occupational injuries has continued to vary over time. In 2005, construction and drilling industries accounted for 137 fatalities while transportation industries accounted for 135 fatalities.39 The combination of these two industries accounted for 55 percent of all occupational fatalities in Texas. It is important to note that long term illnesses that eventually result in death – e.g., asbestos exposure – are not included in BLS fatality data. Since it is difficult to confirm the origin and triggers of these illnesses, the BLS counts traumatic occupational incidents only such as a worker falling at a site or perishing in a refinery explosion. OSHA and the State of Texas are undertaking initiatives to reduce workplace fatalities. Among these initiatives are increased education and training on safety at the workplace and effective worksite management, especially in hazardous industries.

3rd PARTY WORKPLACE INJURY LITIGATION

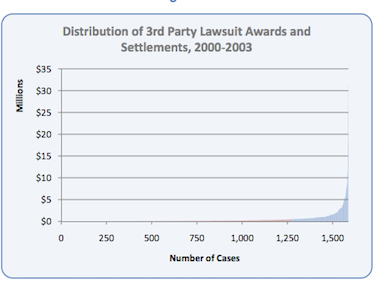

Earlier, this report outlined the economic inefficiency of 3rd party lawsuits for injured workers seeking remedy through the courts. As noted, only 31 cents of every dollar spent on litigation actually accrues to the injured worked compared with nearly double that – 55 cents for every dollar spent – accrued from workers’ compensation benefits. This section identifies a second inefficiency with the current 3rd party liability system: asymmetric distribution of benefits.

Workplace Injury Case Outcomes

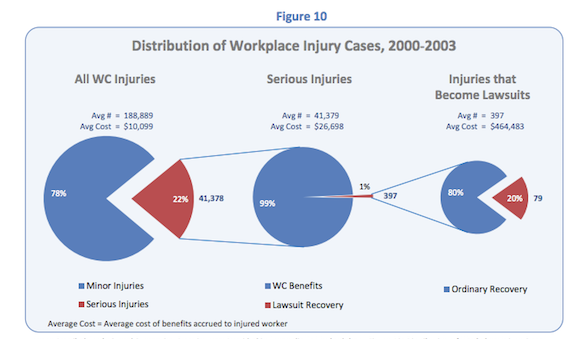

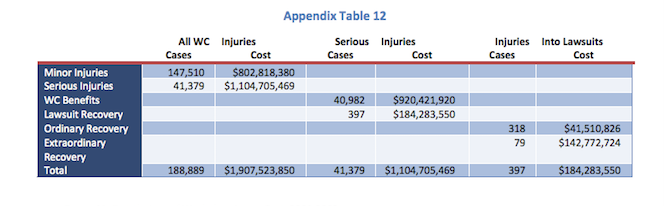

As a proportion of all workplace injuries, 3rd party workplace injury lawsuits arise from a very small number of cases. Of the roughly 190,000 workplace injuries covered by workers’ compensation that occurred during the 2000 – 2003 study period, only about 397 resulted in litigation for amounts in excess of $10,000.40 Figure 10 below breaks down workplace injuries from 2000 – 2003 into three components: severity, litigated cases, and litigated cases which resulted in an extraordinary recovery.41

Figure 10

Note: Detailed Analysis and Supporting Data Sources Provided in Appendix A: Methodology, Figure 10: Distribution of Workplace Injury Cases, 2000‐2003.

In Texas, lawsuits arising from workplace injuries are not significant in number, and lawsuits that result in an extraordinary recovery number only about 1 in every 2,400 workers’ compensation related injuries. However, while the number of injury/illness cases declines when looking at Figure 10 from left to right, the average cost of each type of injury/illness increases dramatically. The increase in average cost is to be expected as serious injuries – those injuries for which IIBs were paid – are by definition more serious in terms of medical treatment required and work loss time, and therefore incur a greater cost. Likewise, injury cases rising to the level of a lawsuit can be assumed to be serious enough in nature to warrant such action.42

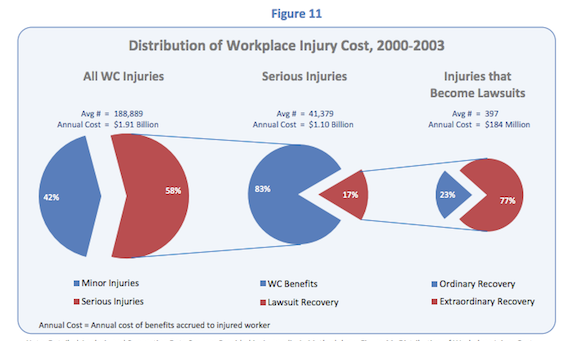

Figure 11

Note: Detailed Analysis and Supporting Data Sources Provided in Appendix A: Methodology, Figure 11: Distribution of Workplace Injury Cost, 2000‐2003.

When workplace injuries are analyzed on a cost basis as illustrated in Figure 11, the impact of each component changes the distribution profile considerably. The relatively small number of lawsuits arising from workplace injuries is directly attributable to the statutory immunity from litigation granted to employers who provide workers’ compensation benefits for their injured employees. However, workers injured as a result of the actions of a non‐related 3rd party do have recourse through the Texas court system. As evidenced in Figure 10 and Figure 11, just 1 percent of injuries – those that seek remedy through the courts – account for 17 percent of serious injury cost. In addition, just 20 percent of 3rd party lawsuits recover 77 percent of the value of all legal awards and settlements.

Major Workplace Injuries and 3rd Party Lawsuits

With regard to participation and non‐participation in the workers’ compensation system, the analysis of legal cases closed between 2000 and 2003 indicated that about 24 percent of cases filed were initiated by injured workers who were not covered by workers’ compensation. This is roughly the same proportion of workers who are not covered by workers’ compensation (see Figure 2). While there is no significant difference in the caseload for injured workers not covered by workers’ compensation, there is, however, a significant difference in the average legal settlements or awards from workplace injury lawsuits.

For the litigation case study period from 2000 through 2003, injured workers with access to workers’ compensation benefits and who filed a 3rd party lawsuit received an average award or settlement of $464,000. During the same period, injured workers not covered by workers’ compensation received a much lower average award or settlement amount of just under $284,000.43 This 39 percent discount in average award or settlement amount may be attributable to the profile of the typical non‐subscriber: small companies. Smaller companies tend to carry lower liability coverage limits and have fewer financial resources to award in a legal dispute.

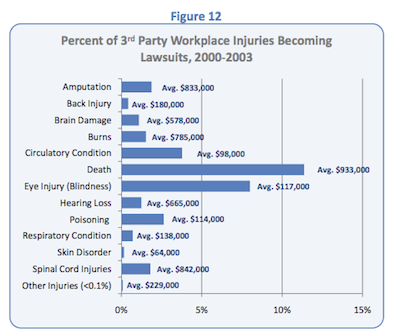

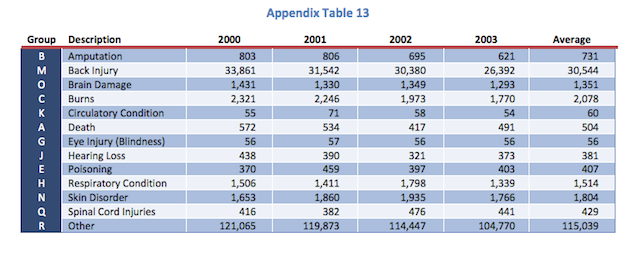

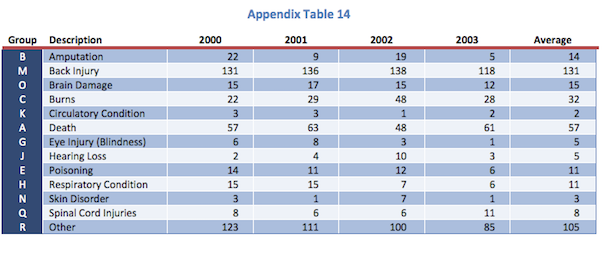

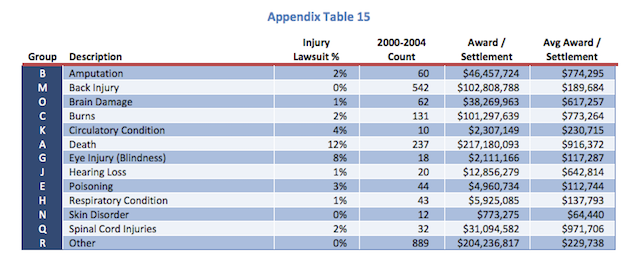

Over two‐thirds of workplace injury lawsuits arise from 12 major injuries (see Figure 12 for complete list). These 12 injuries result in a much higher rate of legal action than all other injury types. Certain injuries command very high award or settlement amounts; for example, Amputation (average $833,000) or Brain Damage (average $577,000). Other injuries command more modest average awards or settlements; for example, Poisoning (average $114,000) or Skin Disorders (average $64,000). While the average award or settlement for any injury type may be large or small, most injury types will have a wide range of results depending on the severity of the injury and the circumstances of the case.

Figure 12

Note: Detailed Analysis and Supporting Data Sources Provided in Appendix A: Methodology, Figure 12: Percent of 3rd Party Workplace Injuries Becoming Lawsuits, 2000‐2003. While the injury categories in each data source were not exact matches, this analysis made a best efforts attempt to group like injuries.

Unpredictability of Lawsuits Awards Leads to Over‐Insurance of Risk

Most companies in Texas carry some form of general liability or multi‐peril insurance policy. These policies cover a wide variety of risk, including 3rd party injury. Most companies will not see one workplace injury lawsuit levied against them this decade44; however, those companies pay a portion of their general liability premium to cover the risk of 3rd party workplace injury lawsuits. Because the range of lawsuit award and settlement amounts

is so vast, many companies are forced to over‐insure themselves by purchasing ever higher liability coverage limits. This additional cost of doing business represents an unnecessary friction on a business’ operating structure.

While business operators most likely understand that their risk of having a 3rd party injury lawsuit brought against them is relatively low, they also understand the level of financial risk posed by a 3rd party injury lawsuit. While the average 3rd party injury lawsuit award or settlement was $464,000 for covered employees during the 2000 through 2003 analysis period, the median recovery was only $125,000. This spread represents the uneven nature of recovery amounts where the actual award or settlement in any case may amount to millions of dollars, or less than $125,000 as in most cases.45 This dynamic encourages companies to focus on financial risk management – ensuring that a company has sufficient insurance or other protections – rather than on preventive safety.

Asymmetric Distribution of Injury Benefits

Figure 4 presented earlier outlined the economic inefficiency in the 3rd party liability system in returning only 26 cents on every dollar spent to injured workers. The second inefficiency that exists in the 3rd party liability system is the asymmetric distribution of benefits. Workers injured in incidents involving their own employers do not have the right to sue for damages; however, similarly injured workers involved in incidents with a company that is not their direct employer may be able to recover a significant damage award via the court system. This phenomenon creates an unequal distribution of injury compensation for severely injured Texas workers.

As illustrated in Figure 10 and Figure 11, a very select group of injured workers receives a disproportionate share of benefits as the result of 3rd party liability suits (see Figure 1346). Among the group of injured workers that pursue legal recourse, disproportionality in legal settlements and awards is even more pronounced. Figure 13 illustrates how even among lawsuit “winners”, a select few cases receive the bulk of the benefit.

Figure 13

Data for Figure 13 was obtained from the TDI’s “Texas Workers’ Compensation System Data Report” 2005 and the Closed Claim Survey data.

The lawsuit count by type of injury as reported in the Closed Claim Database for 2000‐2003 was compared with the total injury count by injury type as reported in the “Texas Worker’s Compensation System Data Report” 2005 to arrive at the percent of 3rd Party Workplace Injuries Becoming Lawsuits by injury type.

The average award or settlement amounts for each injury type was arrived at by taking the average award or settlement amount for each injury type during the study period.

For source reference and detail, please see:

Note: Detailed Analysis and Supporting Data Sources Provided in Appendix A: Methodology,

Figure 13: Distribution of 3rd Party Lawsuit Awards and Settlements, 2000‐2003.

Of the 1,586 cases closed between 2000 and 2003, over 80 percent settled for less than $500,000 with a median settlement of $90,000. For the remaining cases that settled above $500,000, the median award or settlement was $950,000. For injured workers covered by standard workers’ compensation benefits, the average benefit amount paid for serious injuries– those injuries with a PIR – is approximately $22,500.47 This data suggests a significant gap in benefits– an asymmetric distribution of benefits – between injured workers who have legal recourse available to them and those injured workers only eligible for standard workers’ compensation benefits. Roughly 397 injured workers this year will recover an average gross award of $464,000 via 3rd party liability lawsuits while more than 40,000 seriously injured48 workers will receive an average medical and wage benefit of $22,500. To place this into perspective, jury awards or settlements are not based on evaluative criteria and thus may not be consistent with the nature or severity of the injury.

The Case for 3rd Party Litigation Rights

Improving workplace safety and ensuring the health and welfare of employees is “job #1” for all employers. The workers’ compensation compact between employers and employees implicitly maintains that if an injury occurs, all covered workers will receive medical and wage replacement benefits for the duration of their injury regardless of fault in exchange for foregoing the right to legal action in the instances where the employer is at fault. By employing experience modifiers to reward safe employers with lower premiums and penalize less safe employers with higher premiums, the system maintains its own checks and balances.

Arguments defending 3rd party litigation cite the threat of litigation as one of the most important instruments in ensuring workplace safety. While employers have an incentive to engage in safe workplace practices for their employees, the threatof a 3rd party liability suit is the only system check currently in place to incentivize employers to expand their safe workplace practices to include other non‐employees working in and around the job site.

The Impact of Litigation Rights on Employee Safety

Third party liability lawsuits represent one of the levers currently in place for ensuring workplace safety in complex work environments. This lever is reactive however, and by itself does not directly ensure broad adherence to best practices for workplace safety. As noted earlier, the precursor to the long‐term decline in injury rates in Texas and across the United States was not expanded tort access, but rather improved OSHA regulations and enforcement.49 Proactive levers such as experience modifiers and OSHA regulations more broadly impact Texas businesses and are much more significant influencers on workplace safety than the threat of 3rd party lawsuits.

An attitudinal survey of 2,285 companies conducted by the TDI from June through August 2008 revealed that only 14 percent of employers in the state of Texas were concerned about 3rd party workplace injury lawsuits.50 The implication is that the threat of legal action is not a determining factor for employer workplace safety programs for at least 86 percent of Texas employers. The survey results are largely validated by the associated risk. Given that, on average, 525 workplace injury lawsuits are settled each year against Texas businesses regardless of workers’ compensation status, the risk of any given company having to defend a workplace injury lawsuit is 1 in 73551, a relatively minor risk. In addition, the average workplace injury lawsuit is settled in 3 to 5 years, indicating that the lag between unsafe workplace practices and premium impact on the employer is significant.

This decoupling of the “threat” of litigation from improved workplace safety is instructive; regulatory safeguards – a proactive approach to safety – will almost always be swifter and more comprehensive than a reliance on legal action – a reactive approach to safety – to be the safeguard of worker safety.

Risk / Reward Tradeoffs of 3rd Party Litigation

The results of a 3rd party lawsuit can certainly tilt heavily in the favor of the plaintiff. With multimillion dollar recoveries absolutely possible but not guaranteed, the courts system on the surface appears to be a valuable avenue for seriously injured workers.

However, the data suggests that pursuing a 3rd party injury lawsuit is risky in most cases, compared with accepting standard workers’ compensation benefits. If the injuries from Figure 12 are examined in detail, only 5 injury classifications – amputation, brain damage, burns, hearing loss, and spinal cord injuries – have average awards or settlements in excess of $250,000 (excluding death claims). These 5 injury classifications accounted for 21 percent of 3rd party injury lawsuits between 2000 and 2003.

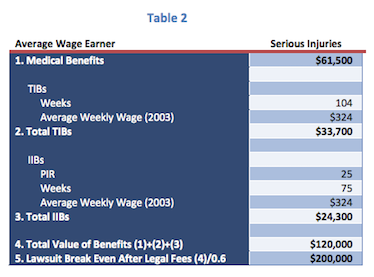

Table 2 presents the scenario of a seriously injured worker who suffers an injury resulting in a PIR of 25 percent after reaching his or her MMI. Medical benefits resulting from the injury are estimated at $61,500. In this example, TIBs are exhausted to their full extent and IIBs are accepted in a lump sum payment. This injured worker earns an average wage compared to others who are injured as well. The resulting benefits value for this seriously injured worker is roughly $120,000. When adjusted for attorney’s fees, the break even value for most 3rd party lawsuits would be close to $200,000. Given that the median award or settlement from 3rd party liability claims is only $125,000, it can be concluded that most 3rd party lawsuits provide no marginal benefit for the injured worker.

Table 2

Based on the analysis of the benefits to the seriously injured worker presented in Table 2, 60 percent of plaintiffs in the 5 high recovery injury classifications listed above, would recover more money than an average standard workers’ compensation package would likely provide. Conversely, 40 percent would fare worse. Among all 3rd party injury claims, only 37 percent recovered more money than the average standard benefits package estimated in this analysis.

REDUCING COSTS BENEFITS TEXAS WORKERS AND BUSINESS

As stated earlier in this document, the best way to reduce the cost of workplace injury and illness is to prevent, or greatly reduce, their occurrence in the first place. However, because workplace injury and illness does happen, it is incumbent upon the State to administer a system that greatly incentivizes safe workplace habits on the part of employers and employees, improves injured worker recovery periods and return‐to‐work outcomes, and delivers the lowest possible cost to Texas business.

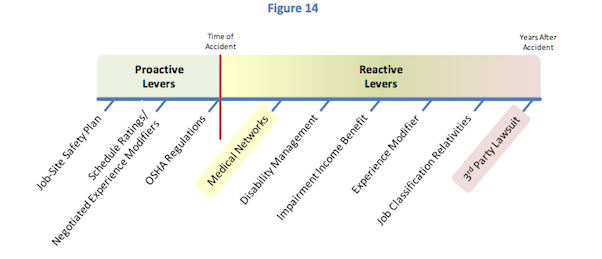

Throughout this report, various incentive levers have been identified. Any new levers introduced should positively impact both business and employee behavior. Behavioral levers can have a significant influence on outcomes depending on whether the lever is proactive or reactive. Among reactive levers, some may be rapid – meaning the lever is released within a short timeframe of an incident to promptly impact behavior – and some may be lagging – meaning a significant amount of time lapses to collect experience data before any impact of prior behavior is experienced. The levers identified in this document are illustrated below in Figure 14.

Figure 14

As Figure 14 illustrates, Job‐Site Safety Plans and OSHA Regulations are proactive levers for protecting workers against workplace injuries and reducing costs by proactively working to reduce the pre‐conditions for workplace injuries.

Employers that proactively design and implement quality job‐site safety plans are more likely to see a beneficial experience modifier that reflects a lower injury/illness rate. Reactive levers range in impact from rapid – medical networks – to lagging

3rd party lawsuits.

As data becomes available over the next few years, workers and business will begin to review whether or not the healthcare delivery network program introduced in 2005 have had the intended result of improving worker recovery times, improving return to work rates, and reducing overall costs. As discussed in the prior section, 3rd party lawsuits are likely the least influential lever on employee and employer behavior for the following reasons: the average time to resolve legal action takes between 3 to 5 years; and 3rd party lawsuits will impact less than 1.5 percent of Texas businesses each decade.

KEY DEFICIENCIES IN THE TEXAS SYSTEM

The benefits package of the Texas workers’ compensation system is similar to those provided in Florida and California. All three states offer full medical benefits and TIBs for up to two years of recovery post injury. Additionally, similar forms of impairment benefits and long term income benefits are also in place for injured workers in each state.

The design of the workers’ compensation benefits system is intended to provide swift access to medical care and rehabilitation so that injured workers can return to work as quickly as possible. Each state continually evaluates the success and weaknesses of their systems and makes improvements as needed to both improve care and reduce cost.

Throughout this report, a variety of weaknesses in the overall workplace injury compensation system were identified. The universal goal should be to provide adequate benefits to injured workers at the lowest cost, while also supporting a mechanism for ensuring worker safety. In analyzing the injury compensation system, it is evident that a major source of inefficiency is the 3rd party liability system. First and foremost, the cost of the 3rd party liability system leaves little for the injured worker. After administrative and legal costs are taken into consideration, plaintiffs, on average, recover just 32 cents of every dollar spent compared to the traditional workers’ compensation system – which returns 55 cents of every dollar spent to injured workers in the form of medical and wage replacement benefits. Secondly, the 3rd party liability system benefits very few injured workers, providing significant benefits for the very few – at a high cost to employers – while providing little incentive for employers to provide a safe work environment.

The analysis performed in this study of the system reveals that there are some potential opportunities to provide greater benefits to injured workers and reduce costs of the overall system – while also maximizing the opportunity to create a system of incentives that encourages greater safety awareness, concern, and action on the part of employers.

This section discusses three what if scenarios that offer ways to improve benefits paid to injured Texas employees and reduce frictional costs for employers. In addition to costs and benefits, another purpose of the discussion is to identify potential opportunities to improve the system of incentives that encourage increased safety on the part of employers.

Option 1: Increase the Maximum Weekly Wage Benefit for TIBs

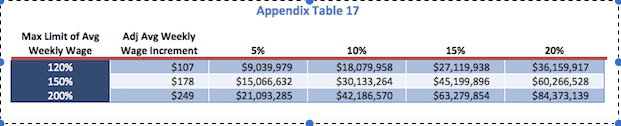

The 2008 maximum weekly wage replacement benefit of $712 is calculated as 88 percent of the average weekly wage for all workers in the State of Texas covered by unemployment insurance. As implied by the term “average”, a significant portion of Texas workers earn more than this “average”. This creates a significant hardship for those specialized workers injured on the job but earning more than the wage replacement benefit.

At $712 per week, this benefit is equivalent to a gross annual wage of roughly $52,900. Specialists such as crane operators, pipe fitters and production engineers can easily earn twice this amount. For injured workers supporting families with mortgages, car payments, and children’s education, any serious injury that results in prolonged absence from work can mean financial disaster for the entire family.

In 2005, the percentage of injured workers earning TIBs and exceeding the maximum weekly wage benefit was 19 percent. While this statistic is based off of a much lower maximum weekly wage benefit ($537)52, the maximum wage benefit has increased 33 percent over the past 3 years. Due to the overall strength of the Texas economy led by high oil and gas prices and recent increases in the minimum wage, this analysis estimates that the increase in the wage benefit cap may have reduced by half the number of injured workers whose wages exceed this cap.

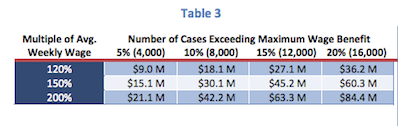

Table 3 outlines the range of incremental costs resulting from increasing the maximum weekly wage benefit. The scenarios presented display a matrix of possible incremental costs from the policy change of increasing the average weekly wage.

The vertical axis of this matrix uses a multiple of the average weekly wage to determine a new ceiling at 120, 150, and 200 percent of the average weekly wage. The horizontal axis displays the estimated cost impacts depending on the number of cases that currently – as of 2008 – involved injured workers whose actual wage exceeds the current maximum wage benefit. The maximum number of injured workers affected is set at 20 percent (the 2005 proportion); however, in 2008 the number of cases – and therefore the most reasonable cost estimate – is most likely closer to the 10 percent column.

Table 3

Option 2: Relax Qualification Requirements for Lifetime Income Benefits

A second benefits deficiency in the Texas workers’ compensation system addresses those injured workers who have exhausted TIBs, IIBs, and SIBs and who still have not returned to work. Approximately 400 injured workers reach this stage in their benefits recovery with approximately half qualifying for LIBs.

To qualify for LIBs an injured worker must have one of the following conditions:

- Total and permanent loss of sight in both eyes

- Loss of both feet at or above the ankles

- Loss of both hands at or above the wrist

- Loss of one hand and one foot at the above locations

- Paralysis of at least two extremities

- Brain trauma resulting in incurable insanity or imbecility

The TDI has performed routine analyses of LIB‐denied claimants and believes that the current qualification system is adequate to address the needs of severely injured Texas workers who cannot return to work – i.e., those who do not qualify for LIBs do not need them. This analysis indicates that LIB non‐ qualification is not a significant problem for injured Texas workers.

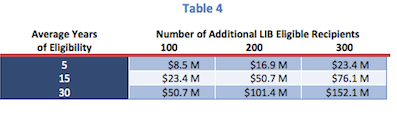

However, if qualifications for LIBs were to be relaxed or extended to current non‐qualifiers, the cost of providing extended benefits could range from $8.5 M to $152.1 M per year depending on the policy choices adopted by the State. Table 4 outlines the potential costs by policy implication. The vertical axis identifies extending benefits for these injured workers for temporary (5‐years) or full‐term (30‐years) periods. The horizontal axis displays scenarios by estimating the number of injured workers covered under new benefits guidelines.

Table 4

Option 3: Redirect 3rd Party Lawsuit Costs to All Seriously Injured Workers

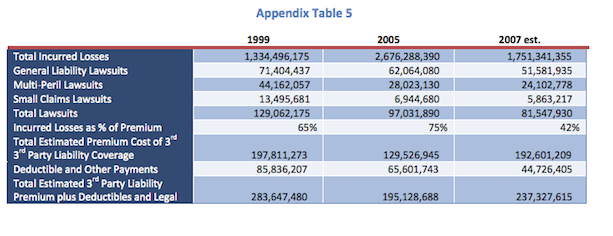

The combined cost of general liability premiums, deductibles and excess award payments in 2007 was approximately $240 million. While this cost represents 1 in 11 dollars spent addressing workplace injuries in the State of Texas workers’ compensation system, these expenditures only benefited 1 in 475 injured Texas workers. This report has previously outlined the two primary inefficiencies of the 3rd party liability system:

Only a small portion of every dollar spent on 3rd party liability lawsuits actually is recovered by the injured party. Only a few employees have access to the courts because of restrictions on suing a direct employer; this creates a system of asymmetric distribution of benefits.

Because of the overwhelming cost of the 3rd party liability system, its inefficient and narrow distribution of benefits, and its relative ineffectiveness in promoting and enforcing workplace safety, this option presents an alternative that provides more widespread distribution of benefits at lower overall cost, and which has built‐in incentives for improved workplace safety.

One option considered here is the introduction of Broad Statutory Employer (BSE) for certain qualifying complex work environments that have multiple employers operating side‐by‐side. In conjunction with BSE, a new Hazard Pay Benefit (HPB) for permanently impaired workers could be introduced. This would be in addition to the benefits currently available through the workers’ compensation program.

While this document does not aim to design specific policy, the intent is to offer the following structure as a guide for discussion. The spirit of this approach is to redirect the money spent on 3rd party lawsuit awards for the relative few, and make that pool of money available for all workers with serious life‐long injuries. Major injuries such as amputation or brain damage would qualify for this HPB, while the typical broken arm would not.

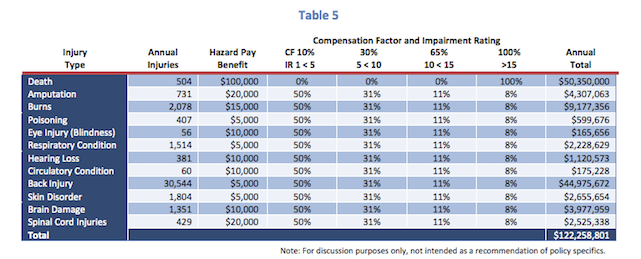

Table 5 outlines a hypothetical HPB structure for serious injuries. A more detailed policy analysis would be necessary to classify type and degree of injury and assign relative HPB values. For this exercise, the total amount of awards or settlements for each injury type was distributed among all injuries in that classification to arrive at a maximum HPB for each specific injury. The spirit of this exercise is to examine how all Texas workers could benefit by substituting the current 3rd party litigation system with an “HPB”/”BSE” based approach.

Table 5

Note: For discussion purposes only, not intended as a recommendation of policy specifics.

It is important to note that this system could be much more efficient in benefit delivery. Employers who choose to manage their HPB risk internally53 would see 100 percent efficiency – only spending money on HPBs when a serious injury arises. Employers who choose to add an additional rider to their workers’ compensation policy would see at least 55 cents of each dollar spent allocated to injured worker benefits system‐wide.

Key benefits for injured workers that the “HPB”/“BSE” program would include:

- A direct lump‐sum benefit, payable within close proximity to the injury.

- A benefit payment that recognizes the long‐term hardship created by the workplace injury regardless of income level.

- Redistribution of the monies currently spent on 3rd party liability insurance and lawsuits to a structure that more efficiently and more equitably provides compensation for all seriously injured workers.

- Rapid feedback – the cost of the HPB – to the employer for unsafe work practices and incentives for vigilance in improving workplace safety.

- Providing a broader reaching incentive – i.e., all employers – for employers to engage in safe practices in the workplace due to rapid payout requirement of Hazard Pay Benefit.

Key benefits for employers that this program would include:

- Eliminating the risk of becoming the unlucky “example” and having to pay a disproportionate settlement above and beyond standard workers’ compensation benefits.

- Providing greater control over costs; managing the risk of a defined benefit

for discrete occurrences lends itself to more proactive behaviors than the 1 in 735 chance of defending a lawsuit. - Remove the risk management focus from litigation protection to workplace safety.

- Reduce a significant portion of insurance costs by eliminating overlapping policies covering the same 3rd party risk while providing an immediate incentive to reduce the occurrence of major accidents, the side‐benefit of which would be a reduction in minor accidents, thereby reducing overall workers compensation costs.

- Encourage unsafe employers to begin to enact more stringent workplace safety programs and thus lower the workers’ compensation system costs for all participants.

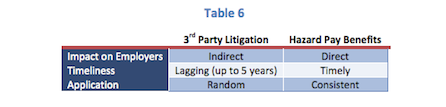

In comparison to 3rd party lawsuits that provide settlements/awards to only a handful of injured workers, HPB would offer a direct, predictable, and consistent mechanism that extends greater benefits to all employees with serious injuries. This approach would be more equitable to seriously injured employees who would be automatically entitled to benefits beyond the standard medical and wage replacement benefits. While it is not the purpose of this study to devise specific incentives to encourage safer behavior among Texas businesses, it is instructive to compare the incentive features of the existing system of 3rd party litigation with the HPB scenario defined here.

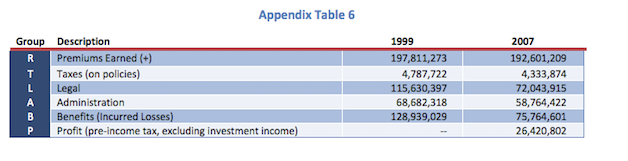

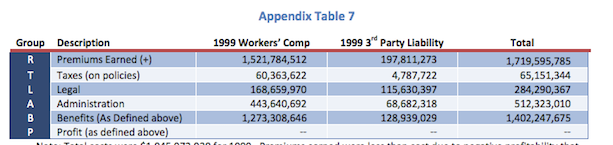

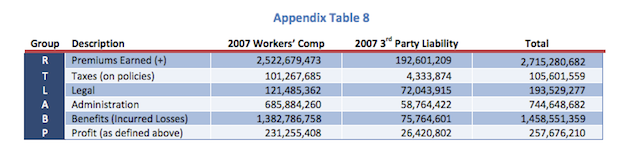

Table 6

The HPB structure would have a much stronger linkage to behavior and safety enforcement than the 3rd party lawsuit approach. It can also be implemented more efficiently by directing a greater portion of the benefit to the injured party.

IN CONCLUSION

The title of this report, Texas Workplace Injury Compensation, purposefully does not include the term workers’ compensation precisely because the extent of workplace injury compensation does not begin or end with the workers’ compensation system. The Texas system is a freedom of choice system which includes businesses that subscribe and businesses that do not subscribe to the workers’ compensation system. The focus of this report is to explore the impact of workplace injury compensation on injured workers and businesses that subscribe to the workers’ compensation system. In addition, this study explores all the relevant major costs of managing workplace injuries, whether through the traditional workers’ compensation system or via 3rd party liability lawsuits. Central to the findings of this report is an analysis of the inefficiencies in the workers’ compensation and 3rd party liability systems. In summary, they are:

- Return on dollar spend of the 3rd party liability system54

- Cost of over-insurance to protect against 3rd party liability claims

- Asymmetric distribution of benefits to injured workers

In addition, the report also identified nine workplace safety and cost containment levers including:

- Job‐Site Safety Plan

- Schedule Ratings

- Negotiated Experience Modifiers

- OSHA Regulations

- Medical Networks

- Disability Management

- Impairment Income Benefits

- Experience Modifier

- Basis of Rate

- 3rd Party Lawsuits

- Ability to be a non‐subscriber55

As previously discussed some of these levers offer a proactive approach to workplace safety and/or cost containment such as Job‐Site Safety Plans and OSHA regulations. Other levers are rapidly reactive such as Medical Networks and Disability Management. Others lag significantly behind the occurrence of the injury and may be administered infrequently; these lagging levers have an almost inconsequential effect on workplace safety but disproportionately affect workplace injury compensation costs – 3rd Party Lawsuits.

The foregoing analysis identifies the strengths and weaknesses of the existing system, and explores potential options for addressing those weaknesses. Two relatively straightforward approaches for increasing benefits and reducing costs were discussed. The discussion around the third option – a hazard benefit pay that provides extra benefits to seriously injured employees – leads to the conclusion that this type of approach would be more efficient, and more effective, than the current 3rd party lawsuit system. For such a system to work, however, broader lawsuit immunity for participants in complex work environments would be necessary to shift the risk management focus from lawsuits to predictable and consistent additional benefits to all seriously injured employees. This kind of system would also potentially provide a more effective incentive for employers to provide a safe work environment for their employees, contracting partners, and guests.

The alternatives presented here provide a directional view of the range of possible outcomes; however, further analysis of these and other options would be necessary to define specific policy recommendations.